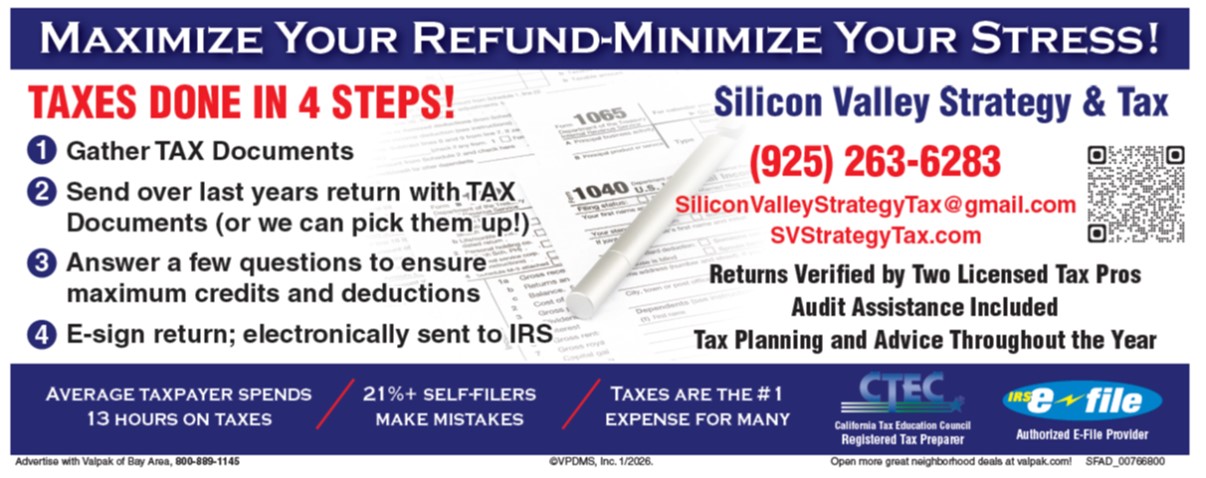

Silicon Valley Strategy and Tax

SVST helps individuals and companies with their strategic planning and tax needs

SiliconValleyStrategyTax@gmail.com

(925) 263-6283

Our Local Ads – Pleasanton, Dublin, San Ramon, Danville, Alamo, Walnut Creek

Check Out Our Blogs:

Tax Articles

Why a True Tax Professional Matters: Maximizing Your Savings

Finding a tax professional who thoroughly understands the tax code and takes the time to optimize your return is essential. Many taxpayers either self-file or rely on preparers who simply input numbers without looking for strategic opportunities. Large-volume preparers, focused on churning out hundreds of returns per year, or generalists in bookkeeping, accounting, or law, often overlook valuable tax-saving strategies. While some advisors push complex tax structures—such as Private Foundations, Trusts, Multi-Entity Business Structuring, Private Placement Life Insurance, or Offshore Strategies—many simple, high-impact savings opportunities can be implemented directly on your tax return…

Keep reading- Why a True Tax Professional Matters: Maximizing Your Savings

- The Pros & Cons of Different Business Structures for Taxes

- Side Hustles & Taxes: What You Need to Know

- Tax Credits vs. Tax Deductions: What’s the Difference & Why It Matters

- Top Tax Credits and Deductions Most People Overlook

Strategy Articles

The Startup Chicken-and-Egg Problem: How to Build a Product Without Funding (And Raise Funding Without a Product)

Starting a company is exciting, but for first-time founders, it presents a fundamental paradox: You need money to build a viable product. Investors won’t give you money unless you have a viable product. This is the classic chicken-and-egg problem of startups. For serial entrepreneurs, this challenge is easier. They can…

Keep readingHow to Raise Money Without a Finished Product: Winning Over Investors with Early Validation

You’ve built a lean MVP, validated the idea, and proven demand. Now, it’s time to raise money; but how do you convince investors when you’re still early-stage? The key is to de-risk the opportunity. Investors don’t just fund ideas; they fund traction and execution. 1. What Investors Need to See…

Keep reading- How to Raise Money Without a Finished Product: Winning Over Investors with Early Validation

- The Startup Chicken-and-Egg Problem: How to Build a Product Without Funding (And Raise Funding Without a Product)

- Strategy First!

- Why Do Inorganic Initiatives Fail?

- Hello? No Response…

- Alignment with Strategic Ambitions is Key

- Primer On Corporate Development: The Driver of Corporate Catalyst

- When Big Corporations Come Knocking