How to Raise Money Without a Finished Product: Winning Over Investors with Early Validation

You’ve built a lean MVP, validated the idea, and proven demand. Now, it’s time to raise money; but how do you convince investors when you’re still early-stage?

The key is to de-risk the opportunity. Investors don’t just fund ideas; they fund traction and execution.

1. What Investors Need to See Before Funding

Investors ask tough questions before writing checks. You need to answer:

Do people actually want this? (Demand validation)

Can this business scale? (Market size + scalability)

Is there early traction? (Users, sign-ups, engagement)

Can the founders execute? (Team credibility + resilience)

The more validation you provide, the easier it is to raise capital.

2. Building Investor Confidence Through Validation

Instead of saying, We need money to build this, shift the pitch to:

We’ve already validated demand. Funding will help us scale.

How to Show Early Traction

- Beta Customers: Have real users tested the product?

- Pre-Sales: Are people willing to pay before full launch?

- Customer Sign-Ups: Have you built a waitlist?

- Engagement Metrics: Are users actively engaging with the product?

3. Structuring Your Investor Pitch

The Core Components of a Strong Pitch

The Problem & Market Opportunity. Why is this urgent? How big is this market?

Your Unique Solution. How is your approach different? Do you understand your competitors – strengths and weaknesses?

Early Traction & Validation. Proof that this works.

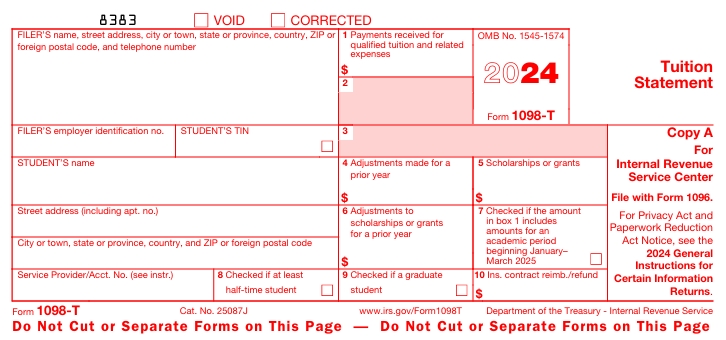

How the Business Makes Money. Revenue model clarity.

What Funding Will Achieve. Clear roadmap for growth.

4. Reducing Risk for Investors

Investors want low-risk, high-reward opportunities.

Start with angel investors or accelerators before approaching VCs.

Use SAFE notes or convertible debt to make early investments simpler.

Set clear milestones and demonstrate steady progress.

Final Thoughts: Progress Over Perfection

Investors don’t need a perfect product, they need proof that people want it.

By validating demand, testing hypotheses, and showing execution, first-time founders can secure funding even without a finished product.

Next steps: Start small, gather data, and turn traction into investor confidence.

Which part of this startup journey do you find most challenging? Drop your thoughts in the comments!

How These Two Blogs Work Together:

✅ Blog 1 focuses on building a startup lean & proving demand.

✅ Blog 2 focuses on turning early traction into investor confidence.

Leave a comment