Side Hustles & Taxes: What You Need to Know

The rise of the gig economy has given millions of people the opportunity to earn extra income through side hustles. This is especially relevant in the Bay Area as a lot of tech based employees are diversify their income stream.

Whether you’re freelancing, driving for a rideshare service, selling products online, or consulting, your earnings come with tax responsibilities that you can’t afford to overlook. Understanding how to handle taxes properly can save you money and prevent costly mistakes.

1. Do You Need to File Taxes on Your Side Hustle?

If you earn $400 or more in self-employment income, you are required to file a tax return and pay self-employment taxes. Unlike W-2 employees, gig workers don’t have taxes automatically withheld from their income, meaning you must track and report your earnings yourself.

2. Filing Taxes with or Without a 1099

Clients or platforms that pay you $600 or more in a year typically issue a Form 1099-NEC or Form 1099-K (for payment processors). However, even if you don’t receive a 1099, you are still legally required to report all income to the IRS. Keep accurate records of all payments received, regardless of whether a tax form is issued.

3. Schedule C: The Key Tax Form for Gig Workers

Self-employed individuals file their business income and expenses using Schedule C (Profit or Loss from Business). This form allows you to deduct legitimate business expenses, reducing your taxable income and overall tax liability.

4. What Expenses Can You Deduct?

Reducing your taxable income with deductions is one of the biggest advantages of running a side hustle. Common deductions include:

- Home Office Deduction – If you have a dedicated workspace used exclusively for your business, you can deduct a portion of your rent, utilities, and internet costs.

- Vehicle Expenses – If you use your car for business purposes, you can deduct mileage (standard IRS rate) or actual vehicle expenses like gas, maintenance, and insurance.

- Supplies & Equipment – Any tools, software, or materials necessary for your work can be deducted.

- Marketing & Advertising – Expenses related to promoting your business, such as website hosting, social media ads, and business cards, are deductible.

- Professional Services – Hiring an accountant, legal professional, or consultant to help with your business can be written off.

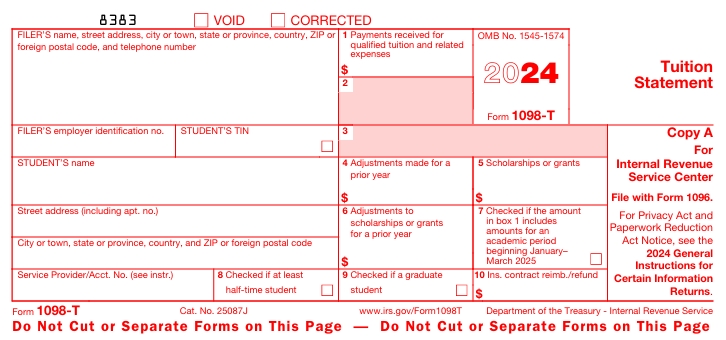

- Education & Training – Courses, books, and certifications that improve your skills for your business are deductible.

- Health Insurance Premiums – If you’re self-employed and paying for your own health insurance, you may qualify for a deduction.

5. Can You Hire Family Members?

Yes! Hiring family members for legitimate business tasks can be a smart tax strategy. Some benefits include:

- Paying Your Children – If you hire your minor child to work in your business (e.g., administrative tasks, social media management, etc.), you can deduct their wages, and they may pay little to no income tax depending on their total earnings. If you pay them below the federal and state filing thresholds, your child won’t need to even file his or her taxes at the end of the year! However, you will still need to file quarterly withholdings for Social Security and Medicare.

- Spouse’s Salary – If your spouse contributes to your business, paying them a salary could allow you to benefit from additional tax-advantaged retirement contributions.

However, their work must be legitimate, and you must document payments properly to avoid IRS scrutiny.

6. Self-Employment Tax and Quarterly Payments

Unlike traditional employees, gig workers must pay self-employment tax, which covers Social Security and Medicare. This tax is 15.3% of your net earnings. Since taxes aren’t automatically withheld, self-employed individuals are required to make quarterly estimated tax payments to avoid penalties.

Estimated tax payment deadlines:

- April 15

- June 15

- September 15

- January 15 (of the following year)

7. Retirement Planning for Gig Workers

Self-employed individuals don’t have access to employer-sponsored 401(k)s, but there are tax-advantaged retirement savings options available, such as:

- SEP IRA – Allows you to contribute up to 25% of your net earnings.

- Solo 401(k) – Great for high earners who want to maximize contributions.

- Traditional or Roth IRA – Ideal for those looking for long-term tax savings.

8. The Importance of Keeping Good Records

Maintaining organized financial records is crucial. Keep track of all income and expenses, save receipts, and consider using accounting software like QuickBooks or a simple spreadsheet to manage your finances. Having accurate records will make tax time easier and help you maximize deductions.

9. State & Local Tax Considerations

Some states have additional self-employment tax requirements, and if you live in a city with a business license tax, you may be required to register your side hustle. Check your local tax laws to ensure compliance.

10. Work with a Tax Professional

Navigating self-employment taxes can be tricky, especially if you’re new to freelancing. We can help you optimize deductions, ensure compliance, and save money in the long run.

Final Thoughts

Taxes for gig workers and freelancers don’t have to be overwhelming. By understanding your responsibilities, tracking expenses, and planning ahead, you can keep more of your hard-earned money and avoid IRS trouble. If your side hustle is growing, consider giving us a call to maximize your financial benefits and minimize your tax burden.

Leave a comment