Top Tax Credits and Deductions Most People Overlook

Tax season can be overwhelming, but it doesn’t have to be financially draining. With the Bay Area tech market facing uncertainty, it’s more important than ever to ensure you’re minimizing your tax burden. Taking advantage of often-overlooked deductions could save you thousands of dollars annually.

Below is a list of commonly missed tax deductions and credits that could benefit you, from basic ones like the Child Tax Credit to more specific scenarios common in the Bay Area, such as the Additional Child Tax Credit, State and Local Tax Deductions, and Wash Sale Recapture.

1. Child Tax Credit and Additional Child Tax Credit (CTC and ACTC)

If you have dependent children under 17, you may qualify for the Child Tax Credit (CTC), worth up to $2,000 per child. This credit is nonrefundable, meaning it can only be used to offset your tax liability. However, the Additional Child Tax Credit (ACTC) offers up to $1,700 per child and is refundable, meaning it can generate a refund even if you owe no taxes.

Eligibility:

- CTC is available if your AGI is below $400K for joint filers.

- ACTC can offer additional refunds if you qualify.

2. Child and Dependent Care Credit (CDCTC)

If you pay for child care expenses for children under age 13, you may qualify for a tax credit based on up to $3,000 in expenses for one child or $6,000 for two or more children. Keep in mind that any employer reimbursement for child care will reduce your allowable credit.

Income Limits:

For an AGI above $43,000, the credit percentage for child care expenses decreases, but two children could still result in a $1,200 nonrefundable credit.

Bay Area Consideration:

Many after-school programs, summer camps, and even sports-related activities may qualify, so be sure to keep records of the organization’s name, address, and TIN.

3. Elderly Parent Dependent Credit – Other Dependent Care (ODC)

Caring for an aging parent can be financially burdensome, but the IRS allows you to claim the Credit for Other Dependents (ODC) for elderly dependents. If you provide over 50% of their support, you may be eligible for up to $500 per dependent.

Eligibility:

- AGI phaseout is $400K for joint filers.

- The parent doesn’t need to live with you to qualify.

4. State and Local Tax (SALT) Deduction

You can deduct up to $10,000 ($5,000 for married filing separately) in state and local taxes, including property taxes and income tax. While the SALT deduction has been capped since 2018, it remains valuable, particularly for those living in high-tax states like California.

Tip:

If you exceed the $10,000 cap, any excess may reduce taxable state refunds in your federal return in future years, helping to offset tax liability.

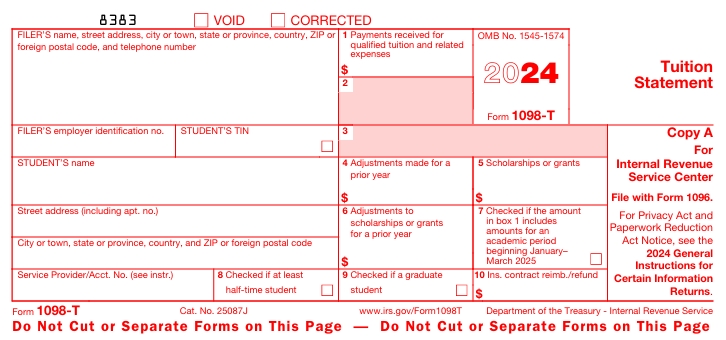

5. Education Credits (American Opportunity & Lifetime Learning Credit)

If you or your dependents are pursuing higher education, don’t overlook education credits:

- The American Opportunity Tax Credit (AOTC) provides up to $2,500 per eligible student per year for the first four years of college.

- The Lifetime Learning Credit (LLC) allows for a credit of up to $2,000 per tax return for higher education expenses, with no limit on the number of years it can be claimed.

AGI limits for married filing jointly is $160K to $180K for 2024.

6. Mortgage Interest Deduction

Homeowners can deduct mortgage interest paid on loans up to $750,000 ($1 million if taken before 2018). This deduction can be a game-changer for those paying significant interest on their home loans.

7. Self-Employment Deductions

Freelancers and business owners can deduct many expenses, such as:

- Home office deduction (if used exclusively for business)

- Health insurance premiums

- Business meals and travel

- Retirement plan contributions

8. Charitable Contributions

For 2023, you can deduct up to $300 in cash donations to qualifying charities without itemizing. For larger donations, if you itemize, you can deduct up to 60% of your AGI.

Note:

For 2024, you’ll need to itemize to claim charitable contributions.

9. Energy-Efficient Home Improvement Credits

Upgrading your home with energy-efficient improvements, such as solar panels or heat pumps, can earn you tax credits. The Residential Clean Energy Credit allows for a 30% credit on qualified expenses for home energy improvements.

10. Student Loan Interest Deduction

Borrowers can deduct up to $2,500 in student loan interest paid, even if they don’t itemize deductions.

The MAGI phaseout is between $165K to $195K for joint filers.

11. HSA and FSA Contributions

Contributions to a Health Savings Account (HSA) or Flexible Spending Account (FSA) are tax-deductible and reduce your taxable income. HSAs offer a triple tax advantage: tax-free contributions, tax-free growth, and tax-free withdrawals for qualified expenses.

12. Investment Losses & Wash Sale Rules

If you sold investments at a loss, you can use those losses to offset capital gains and up to $3,000 of ordinary income.

However, be mindful of wash sale rules, which disallow claiming a loss if you repurchase the same or substantially identical investment within 30 days before or after the sale. The loss is not entirely lost. Instead, the loss is added to the basis of the new security that you purchased. This effectively reduces your capital gains tax liability in the future when you eventually sell the new investment.

13. Roth IRA Conversions & Backdoor Roth IRA Contributions

While Roth IRA contributions are not deductible, converting a traditional IRA to a Roth can have tax advantages in the long run. Additionally, high-income earners can use a Backdoor Roth IRA strategy to contribute to a Roth IRA indirectly.

14. 529 Plan State Tax Deductions

Many states including California offer tax deductions or credits for contributions to 529 college savings plans, which grow tax-free when used for qualified education expenses.

This is particularly valuable for families who rely on their stock and equity portfolios to save for college, hoping that future gains will cover tuition costs. However, those investment gains are taxable. In contrast, contributing to a 529 plan today means that any future gains withdrawn for educational expenses are completely tax-free, providing a more efficient way to save for college.

Final Thoughts

Maximizing your deductions and credits requires careful planning. Many of these tax-saving opportunities can significantly reduce your tax bill. Don’t leave money on the table—contact us to ensure you’re taking full advantage of every available tax benefit!

Leave a comment