Why a True Tax Professional Matters: Maximizing Your Savings

Finding a tax professional who thoroughly understands the tax code and takes the time to optimize your return is essential. Many taxpayers either self-file or rely on preparers who simply input numbers without looking for strategic opportunities. Large-volume preparers, focused on churning out hundreds of returns per year, or generalists in bookkeeping, accounting, or law, often overlook valuable tax-saving strategies.

While some advisors push complex tax structures—such as Private Foundations, Trusts, Multi-Entity Business Structuring, Private Placement Life Insurance, or Offshore Strategies—many simple, high-impact savings opportunities can be implemented directly on your tax return with minimal effort.

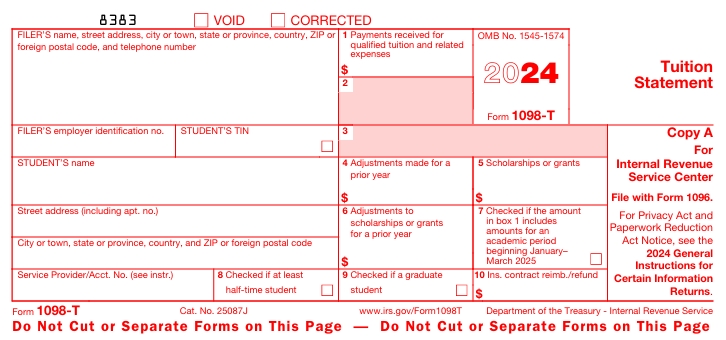

A Simple Example: Maximizing the American Opportunity Tax Credit (AOTC)

Consider a family with a child in college who qualifies for the American Opportunity Tax Credit (AOTC)—worth up to $2,500 per year for tuition, fees, and course materials during the first four years of college.

A typical tax preparer will:

- Take the numbers from Form 1098-T,

- Include additional eligible expenses (e.g., books and fees),

- Subtract any scholarships listed in Box 5, and

- Enter the difference into Form 8863 to calculate the credit, which flows to the 1040.

A true tax expert, however, will take a more optimized approach:

- Instead of reducing eligible expenses by the full scholarship amount, they will apply only $4,000 of expenses toward Form 8863 (the maximum needed to claim the full $2,500 AOTC).

- Any remaining expenses beyond $4,000 exceeding this threshold will be subtracted from any scholarships received and the difference reported as taxable income on Schedule 1 (Scholarship and Fellowship Grants not included on Form W-2).

- Why? The strategy works because a refundable tax credit like AOTC is worth more than the small amount of tax paid on scholarships – often at a low tax rate. By making this small adjustment, the amount of AOTC is maximized reducing overall tax liability—which is a crucial benefit many standard tax preparers overlook.

The Result?

A simple adjustment such as this can increase tax savings by $200 to $1,000, depending on the taxpayer’s situation. Now, imagine finding multiple opportunities like this throughout your return—these small tweaks can add up to thousands of dollars in savings.

This is why working with a tax professional who goes beyond data entry to strategically optimize your return is critical. If you want a team dedicated to ensuring you get the maximum benefit from your tax filing, reach out today.

Leave a comment